“They will need to upfront state that they are under the composition levy… They will not charge GST from customers,” said a government official.

Composition scheme norms specify that the entity has to mention the words ‘composition taxable person, not eligible to collect tax on supplies’ at the top of the bill of supply. ‘Composition taxable person’ has to be displayed prominently at all places of business.

“Since composition dealers are not allowed to collect GST from the customers, a display is needed for consumer’s information and protection,” said Pratik Jain, leader, indirect tax, PwC. “In the case of a normal dealer, GST has to be mentioned on the invoice along with applicable HSN (Harmonized System Nomenclature) codes.”

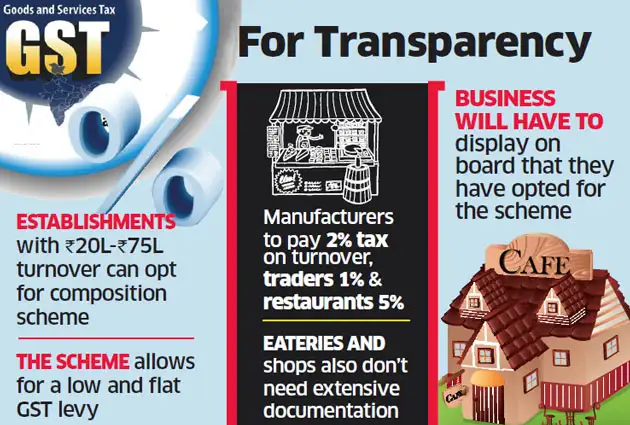

The scheme for small traders, manufacturers and restaurants allows for a low, flat GST levy. Also, they don’t need to maintain extensive documentation.

Those with a turnover from Rs 20 lakh to Rs 75 lakh-Rs 50 lakh in the case of special category states–can pay tax at a prescribed percentage of turnover every quarter instead of normal GST rates every three months. Businesses with a turnover up to Rs 20 lakh are exempt under GST. Those opting for the composition scheme won’t be eligible for input tax credit.

Under the scheme, manufacturers need to pay 2 per cent of turnover (1 per cent central tax and 1 per cent state tax), traders need to pay 1 per cent (0.5 per cent central tax and 0.5 per cent state tax) while restaurants face 5 per cent tax (2.5 per cent central and 2.5 per cent state tax). The composition levy saves small entities the hassle of audits and maintenance of books. The scheme is not open to those who deal in ice cream, pan masala and tobacco products. In services, only restaurants have the option.

ET View: Boost For Consumers

Transparency in the pricing of a product makes eminent sense as a measure of consumer protection. Dealers under the composition scheme do not pay GST .

They do not have to maintain detailed records as a normal tax payer , and are also not eligible to claim credit on the taxes paid on inputs in the production chain. But the need is to ensure that dealers do not face undue harassment from tax authorities. There should be no inspector raj.